KoverNow Hong Kong and Aristo Watch Partner to Offer First Digital Insurance for Luxury Watches

Empowering Hong Kong consumers with digital insurance for luxury items and collectibles Singapore & Hong Kong, February 3, 2025 – KoverNow is proud to announce its official licensing by the Hong Kong Insurance Authority as an insurance agency and the launch of the Hong Kong app in both iOS and Android. This milestone makes KoverNow’s […]

KoverNow and Aristo Watch Partner to Offer Hong Kong’s First Digital Insurance for Luxury Watches

Empowering Hong Kong consumers with digital insurance for luxury items and collectibles Singapore & Hong Kong, February 3, 2025 – KoverNow is proud to announce its official licensing by the Hong Kong Insurance Authority as an insurance agency and the launch of the Hong Kong app in both iOS and Android. This milestone makes KoverNow’s […]

KoverNow Secures Insurance Intermediary License in Hong Kong and Officially Launches Local App

Empowering Hong Kong consumers with digital insurance for luxury items and collectibles Singapore & Hong Kong, February 3, 2025 – KoverNow is proud to announce its official licensing by the Hong Kong Insurance Authority as an insurance agency and the launch of the Hong Kong app in both iOS and Android. This milestone makes KoverNow’s […]

Can Luxury Watches Beat Real Estate Investment? New Study Says Yes

You might be surprised to discover that the next big investment opportunity is ticking quietly on your wrist—luxury watches. A recent study suggests that some of these high-end timepieces may offer impressive returns, potentially surpassing even traditional staples like real estate. Let’s delve into why luxury watches could be the hidden gold mine you never anticipated.

Can Luxury Watches Beat Real Estate Investment? New Study Says Yes

You might be surprised to discover that the next big investment opportunity is ticking quietly on your wrist—luxury watches. A recent study suggests that some of these high-end timepieces may offer impressive returns, potentially surpassing even traditional staples like real estate. Let’s delve into why luxury watches could be the hidden gold mine you never anticipated.

KoverNow celebrates admission into Cyberport Incubation Programme

KoverNow has been accepted into Hong Kong’s digital technology flagship and key incubator, Cyberport.

KoverNow X Aristo Watch: Introducing Hong Kong’s 1st Luxury Watch Digital Insurance

We’re thrilled to announce our groundbreaking partnership with Aristo Watch, one of Hong Kong’s premier luxury watch retailers, introducing the city’s first fully digital luxury watch insurance solution.

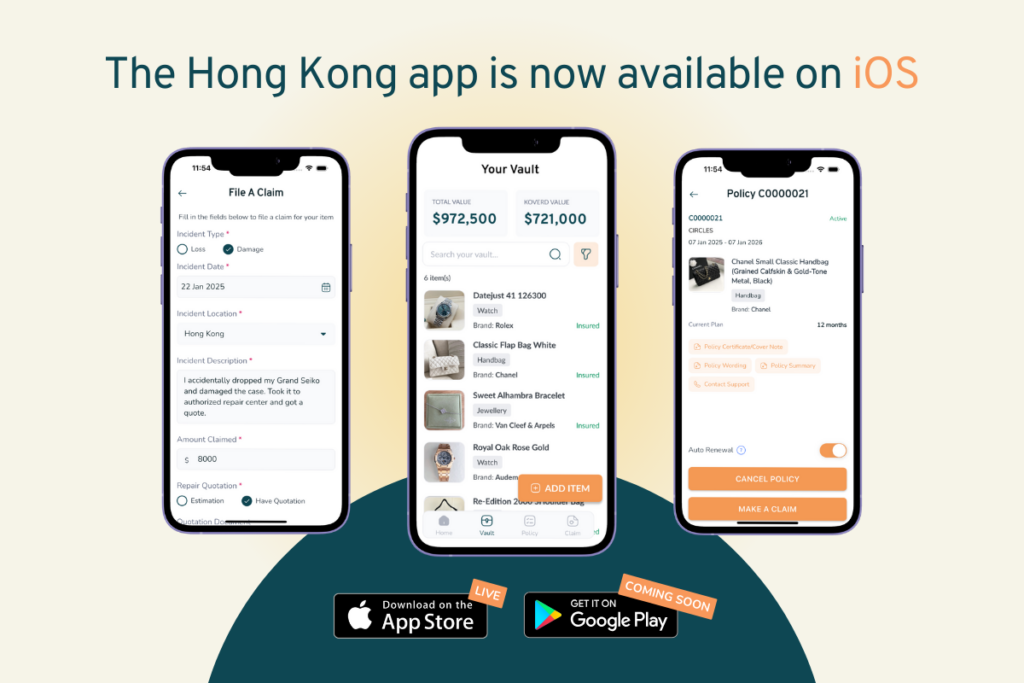

KoverNow Hong Kong App: Now Available on iOS and Android

Great news for luxury collectors in Hong Kong—KoverNow has officially launched its digital insurance platform on both iOS and Android, making it easier than ever to protect luxury items and collectibles!

KoverNow Secures Insurance Intermediary License in Hong Kong and Officially Launches Local App

Empowering Hong Kong consumers with digital insurance for luxury items and collectibles Singapore & Hong Kong, February 3, 2025 – KoverNow is proud to announce its official licensing by the Hong Kong Insurance Authority as an insurance agency and the launch of the Hong Kong app in both iOS and Android. This milestone makes KoverNow’s […]

KoverNow in Hong Kong: Now Available on iOS – Digital Insurance for Luxury Items and Collectibles

KoverNow is excited to announce the launch of its fully digital insurance platform on iOS in Hong Kong. Built for collectors with specialized coverage, the app provides seamless insurance solutions for high-value items such as luxury watches, jewellery, and handbags, combining convenience, speed, and security—all in one place.

KoverNow celebrates admission into Cyberport Incubation Programme

KoverNow has been accepted into Hong Kong’s digital technology flagship and key incubator, Cyberport.

Laying the foundations for growth at KoverNow

As we come to the end of 2024, we thought it was worth reflecting on the exciting year we have had before we look ahead to 2025.

KoverNow, The “Netflix” of Insurance!

Imagine insurance as flexible as Netflix. That’s what we’ve created at KoverNow—a subscription-based insurance model that gives you the freedom to cover your valuables exactly when you need it, without being tied to long contracts. With this innovative approach, KoverNow offers an easy way to protect your cherished items such as luxury watches, jewellery, handbags, […]

KoverNow hits the stage in Hong Kong

We have a busy run up to the end of the year with involvement at several prestigious events in Hong Kong: CDO Innovation Forum, Hong Kong Fintech Week and Insurtech Insights Asia

Hong Kong’s wealthy and digitalised buyers set global standards

Hong Kong is proving to be a magnet destination for the world’s top auction houses. Christie’s is moving its regional HQ to the new Henderson skyscraper this month, while Sotheby’s, Bonhams and Philips are all establishing themselves in the city. The reason, it would seem, is that to counteract the global slowdown in art sales, the auction houses are hoping to attract the ultra-high end of the Asian market who they believe are active in Hong Kong.

Insurers still lagging behind when it comes to digitalisation

It is widely acknowledged that insurance companies are not maximising the potential of digital channels when it comes to selling policies. While most offer some online services, the truth is that they are not delivering a seamless end-to-end digital journey for customers.

KoverNow’s new Hong Kong operation strengthened by two key appointments

KoverNow has announced the appointment of two new executives to join its growing team in Hong Kong.

Taking cover this Summer, and not just from the sun!

Anyone can experience unexpected challenges when travelling, which is why travel insurance is so important

From Singapore to Hong Kong – protecting the crown jewels of luxury shopping

Singapore has long been associated with luxury, and the market for high end goods continues to thrive. According to Mordor Intelligence, the market is projected to register a CAGR of 4.64% between 2022 and 2027.

Going on vacation? Don’t risk your trip by opting for ‘tickbox insurance’

Traditionally, travel insurance policies are sold as an after-thought, something you’re offered when you’ve made your travel arrangements and before the final online checkout. It’s convenient, but does it provide you with the best cover for your needs?

KoverNow expands with appointment of John Trotter as CSO and MD of Hong Kong

KoverNow has announced the appointment of John Trotter, the financial services business development expert, as Chief Sales Officer and Managing Director for Hong Kong.

Majority of Singaporeans Now Purchase Travel Insurance Through Digital Channels & Favor ‘Metered’ Policies, KoverNow Survey Finds

KoverNow has revealed the results of a new survey, conducted in co-operation with the National University of Singapore.

Max Miles Points for KoverNow Users with Every S$ Dollar Spent

Discover a new way to earn rewards with KoverNow’s digital insurance platform. Partnering with Heymax, customers can earn points with every policy purchased.

Paying too much for insurance? It’s not a problem with KoverNow

Learn about the importance of accurate insurance coverage for luxury watches. Find out how KoverNow ensures fair premiums and accurate coverage.

How easily accessible insurance can build resilience

The Singapore Resilience Study, which was conducted recently, has found that Singaporeans are regarded as resilient in terms of mental, physical, social and financial well-being. Unsurprisingly, married individuals are more likely to have greater social and financial resilience than single people because they benefit from dual-income households, and respondents that live in private housing had […]

Unlocking Retail Success: The KoverNow Advantage

🌟 Did You Know? A significant number of luxury goods and lifestyle products aren’t covered under a standard home contents policy. This is where the KoverNow Partner Program steps in, offering retailers a golden opportunity to stand out and provide unmatched value to their customers. 🔥 Why KoverNow is a Game-Changer for Retailers: 🎯 […]

Worried about losing or damaging your valuables on your next overseas trip? The KoverNow app has you covered!

A trip overseas can quickly turn from an opportunity to a disaster, not only due to flight interruptions or medical needs but if the traveller loses or damages their valuable belongings like a laptop, camera or watch. To go overseas with peace of mind, travel insurance may not provide sufficient cover for more valuable items due to its low limits. That´s why KoverNow now offers a combination of both travel insurance and dedicated items insurance in just one app.

Expansion of Partner Program Means KoverNow Provides Insurance at Point of Sale for Singapore’s Luxury Retailers

Retailers of high end watches, jewellery, designer handbags, cameras and laptops are being invited to offer customers insurance to protect their luxury items at the moment of purchase, as part of a program launched by KoverNow, the mobile insurance app company.

We’ve made it onto the InsureTech Connect Forward50 APAC list!

The insurance industry is on the brink of a digital revolution, and KoverNow is at the forefront of this transformation. Recently, KoverNow made a significant leap by being featured in the InsureTech Connect Forward50 APAC list, a curated report highlighting the leading emergent startups driving change across the insurance sector. Forward50 APAC: Recognizing Innovation in […]

Travel insurance is now available on the KoverNow app, delivering end-to-end digital insurance management experience for today’s consumers

Encouraged by the traction with customers using KoverNow to protect their luxury goods with on-demand insurance against loss and damage, the brand is now expanding its service offering to include travel insurance. This underlines KoverNow’s mission to provide effortless end-to-end digital insurance for the things that matter most to people.

Interview with Claire Kent (luxury goods advisor and non-executive director at Prada S.A )

Q: The luxury vintage trend is proving popular with younger consumers. Do you think that young people rejecting fast fashion is also boosting purchases of new luxury items? Claire Kent: The luxury vintage trend is extremely popular with some younger consumers for many reasons – but primarily because many care about the environment and hence […]

KoverNow Appoints one of Singapore’s Most Prominent Marketing and Data Science Experts as Non-Executive Director

KoverNow has announced the appointment of National University of Singapore (NUS) Associate Professor of Marketing, Juin-Kuan Chong. Professor Chong, who is a behavioral scientist and data scientist by training, currently carries out research focusing on the challenges of nudging people to adopt useful technology. He joins KoverNow as a non-executive director.

Removing the complexity from insurance

Insurance is one of those necessary, but dull, topics. It is often an add-on after purchasing something expensive or a way to protect the value of a precious item. Taking out an insurance policy is considered ponderous and time-consuming, but for something so mundane, it can be unnecessarily complicated. And it really doesn’t need to […]