Travel Insurance

Going on a holiday or an adventure? Get comprehensive coverage with everything you need and nothing you don’t.

Coverage Highlights

Medical Coverage up to S$1,000,000

Covers overseas medical treatment, hospitalisation, and follow-up care in Singapore

24/7 Overseas Medical Assistance

Immediate support for injuries or emergencies while abroad

Unlimited Emergency Evacuation

Covers medically supervised transport home or to a suitable facility abroad

Trip Cancellation or Curtailment

Reimburses non-refundable bookings if your trip is cancelled or interrupted due to covered events

Baggage Loss or Delay

Covers damaged, stolen, lost, or delayed luggage and personal belongings

Travel Delay & Missed Connections

Compensation for delays, overbooked flights, or missed transfers

Daily Hospital Cash

Pays a fixed daily benefit if you’re hospitalized overseas

Terrorism Cover

Covers accidental death or injury resulting from acts of terrorism*

*Territorial restrictions apply

Policies underwritten by QBE Insurance (Singapore) Pte Ltd

The Journey of Insuring Your Passion

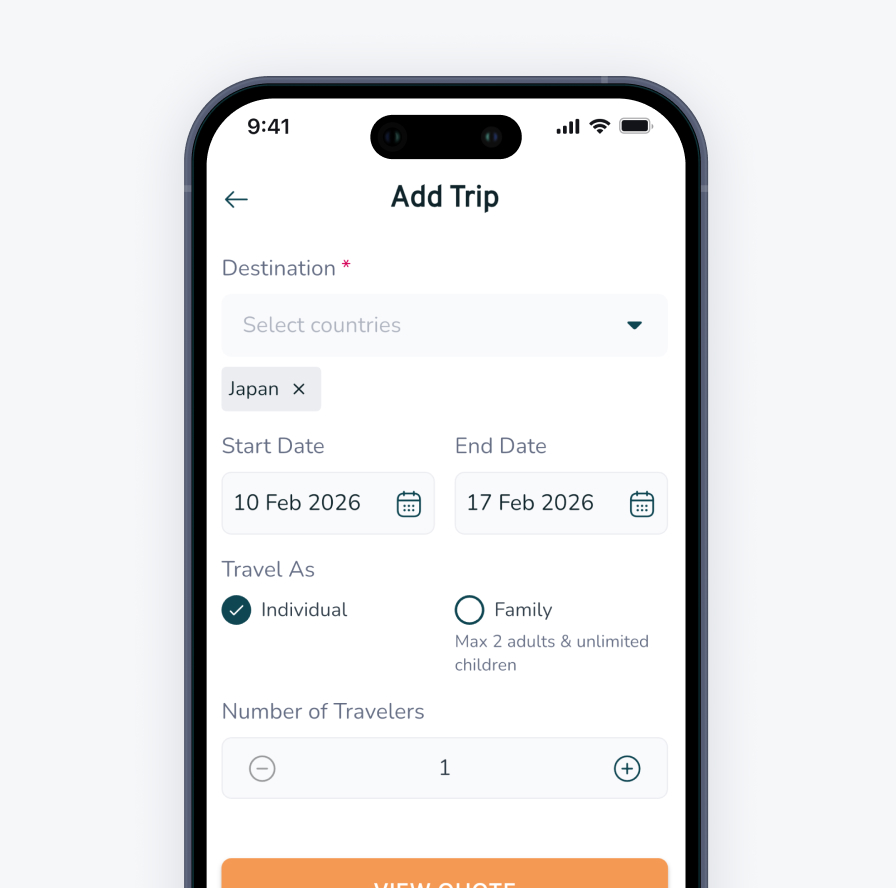

1

Quick & Easy Set Up

Set up your travel insurance in just a few taps. Whether you’re traveling solo or with family, getting covered is simple and fast

2

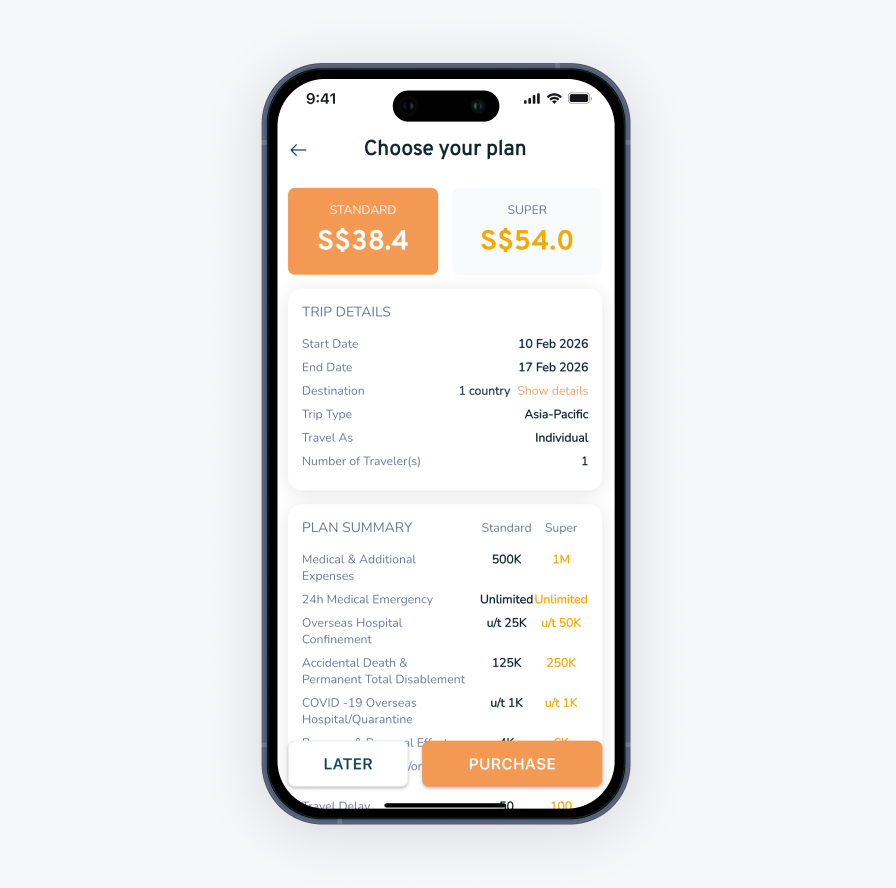

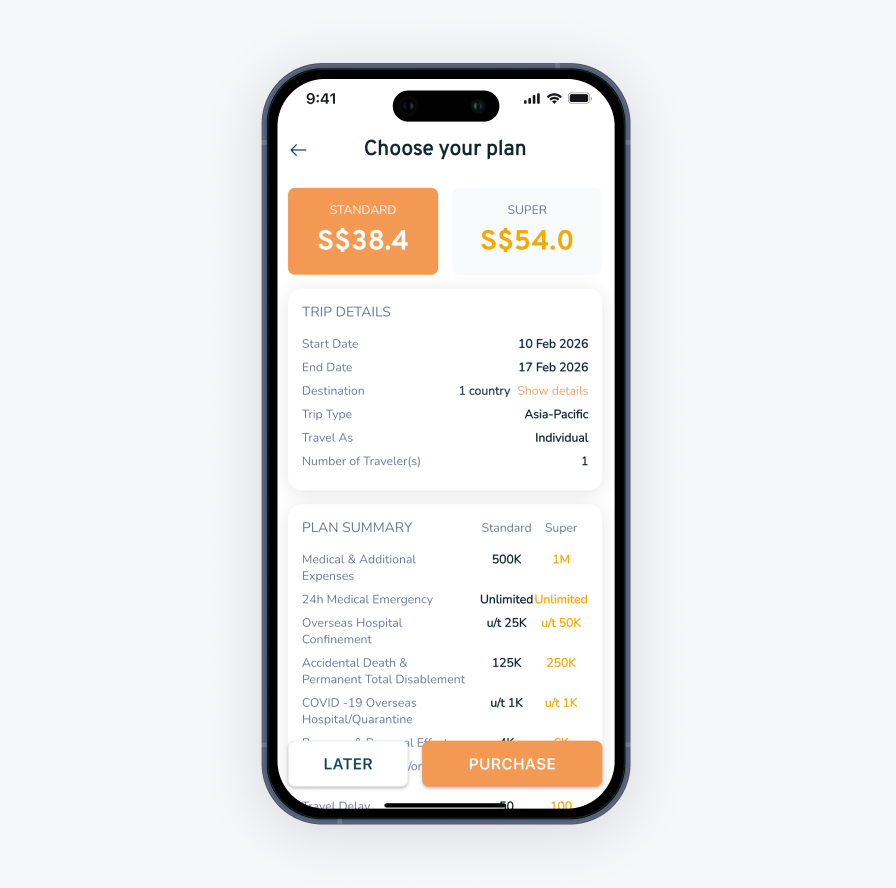

Free and Instant Quotes

Get instant quotes and compare plans side by side and choose the coverage that fits your needs—medical expenses, emergency assistance, and more.

2

Free and Instant Quotes

Get instant quotes and compare plans side by side and choose the coverage that fits your needs—medical expenses, emergency assistance, and more.

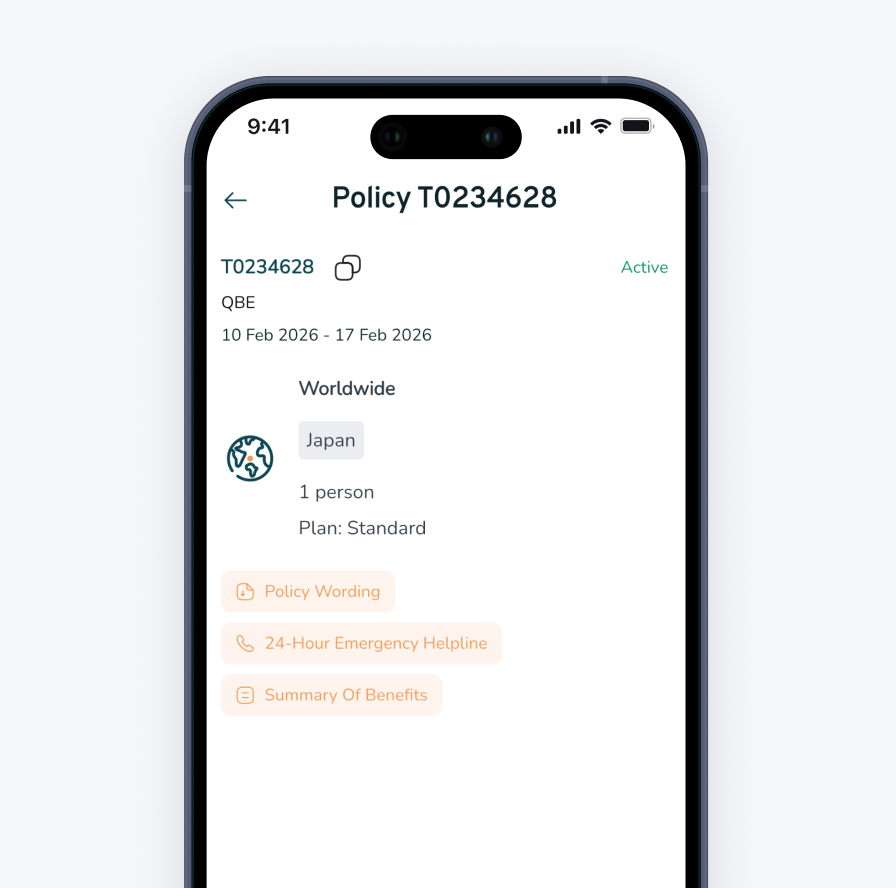

3

Effortless Policy Management

Access all your travel policies anytime through the app. View your coverage details, emergency helpline, and benefits summary in-app easily.

What to do when the unexpected happens?

1

Initiate a claim via QBE eClaim portal with your policy number. In case of any incidents, prepare the required documents and submit them within 30 days.

2

You will receive confirmation and claim status via email.

3

QBE’s claims department will assign a specialist to handle your claim and will contact you directly if further information is required.

QBE Singapore 24-Hour Emergency and Assistance Helpline (65) 6322 2688

FAQs

Yes. We offer individual and couple/family travel plans.

This is because while most of your travel cover only kicks in with you commencing the trip, some protection is already effective with the purchase of the policy. Loss of deposits and the failure of your travel agent are for example protected from the purchase date. For our underwriter to manage those risks effectively, exposure to those risks is limited to 90 days.

Our Travel Insurance is designed to cater to all types of travelers, whether you’re traveling for business or pleasure. Our enhanced Standard Plus and Super Plus plans offer comprehensive protection for everything from small annoyances to significant crisis, ensuring you’re covered on every trip.

Our coverage is worldwide, with some territorial limitations. This may change from time to time, depending on global sanctions and conflicts. For updated lists of exclusions, please refer to the Travel Policy Wording.

We are available to all legal residents of Singapore of legal age, with access to SingPass:

- Singaporean permanent residents

- Singapore citizens

- Workpass holders

Because our travel cover is enjoyingly comprehensive and protects you from a variety of unexpected events that could happen during a trip, you can have multiple claim elements under a single policy. To be sure that all your claim elements get dealt with all together efficiently, we chose to link you directly to the QBE claims portal.

Ready to protect your next adventure?

The KoverNow app provides exceptional coverage for your items and trips as well as fully digital claims journey. Get free and instant quotes today.